Smart College Spending

The transition from living at home to going to college can be difficult. Making smart choices on how to spend money isn’t easy when you have to juggle expenses for tuition, food plans, text books, and extra-curricular’s such as clubs, sororities, fraternities, and sports. Whether it be a community, private, or public college, students face a hard decision nearly every day when it comes to their wallets.

Yet there are many ways to save money in college, even if it is just a small amount at a time. The first step toward smart college spending is to save money before going to college. Start by getting a job over the summer and consider getting a part-time job when classes start. Many colleges offer on campus jobs that work around students’ schedules.

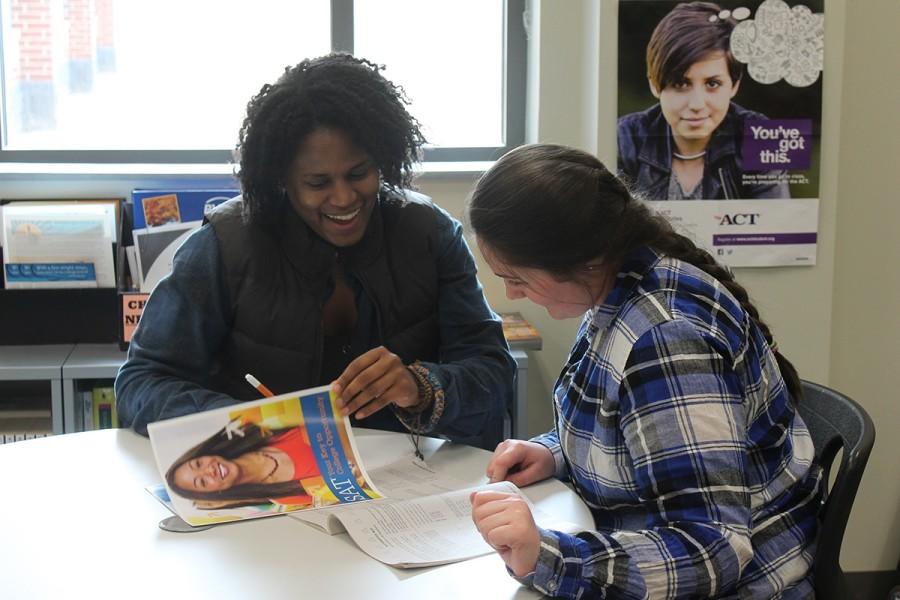

The next step is to minimize college search and application fees. Application fees range from $0 for community college to an average of $38 for most colleges, but can reach as high as $90 at top universities like Stanford. While it may sound great to say “I’m applying to eight colleges,” you’re better off saving the money and not applying to colleges you have no real intention of attending. You can also save money by carefully planning those college visits. According to Marketplace.org, the average family spends $3500 on college visits. You can make those dollars count by research colleges and majors of interest before making the trip, and by visiting colleges with friends so you can share travel costs. Although it requires time and discipline, a third way to save money before attending college is to search for academic and extracurricular scholarships. The FCHS Guidance Department keeps a list of upcoming scholarships deadlines which could potentially save you thousands on tuition.

Once you’re at college, keep a record of your spending and make a budget. The average college students spent $765 on food alone in 2011, much of it unnecessary spending. “A major tip while at college would be to follow the food plan that is already paid for rather than going out to eat often,” said Dylon Garrett, a freshman at Mary Washington. “Keeping snacks in my room that are quick and easy help hold me over if I’m ever hungry rather than going out all the time,” said Troy Coleman, a freshman at Methodist University.

Another helpful tip for surviving tempting college spending is to buy used textbooks and sell them back. “Never buy brand new textbooks,” said Morgan Sapp, a 2014 graduate of Fluvanna County High School. Buying used textbooks or finding websites that sell or rent books such as Chegg.com and Valorebooks.com can help save you lots of money. And be sure to take good care of textbooks so you can sell them back to local book stores when classes end.

Finally, try to save money by pooling expenses while in college. For example, you can save on transportation to and from college by carpooling with friends from the surrounding area. When getting an apartment, get as many roommates as possible to share the rent, and split responsibilities around the apartment.

Making smart spending choices during the perplexing transition from living at home and going off to college isn’t easy. Students face many hardships on a daily basis primarily dealing with money and must know when to say “no.” But just remember this: Saving money before, during and after college will not only positively shape your experiences in college, but also give you a financial leg up in the future.